There are several actions that could trigger this block including submitting https://www.xcritical.com/ a certain word or phrase, a SQL command or malformed data.

- This can result in a rise in token value, higher returns for investors, and an attractive investment opportunity.

- When a certain number of crypto tokens are said to be burnt, it means they have been permanently pulled out of circulation.

- So this permits a balance between the new users and the old guard.

- With some coins worth much less than a penny, this may lead to regrets later on, especially if you burned thousands at a time.

- A coin burn quite literally locks away digital assets and throws away the private key.

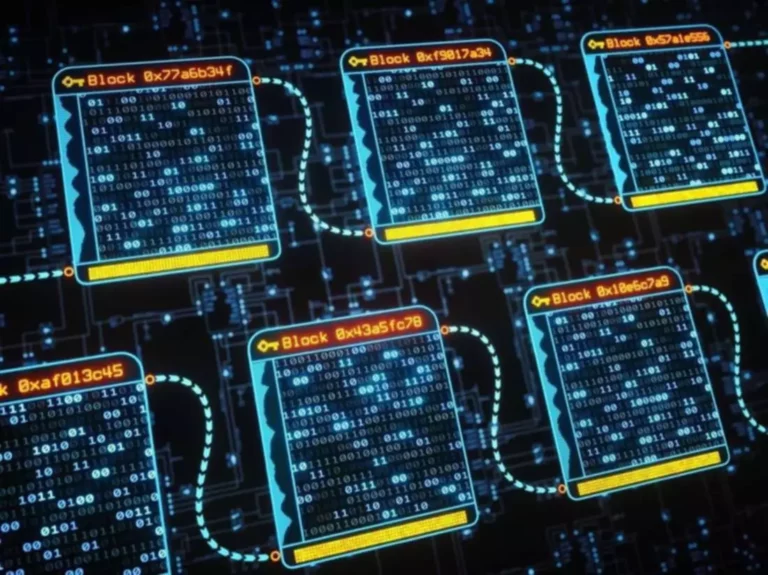

Proof of burn is a consensus algorithm that blockchains can use to validate and add transactions. It’s used to prevent fraud and ensure that only valid transactions go through. • Coin burning may enhance a crypto’s value by limiting the supply. An uptick in price isn’t guaranteed from a coin burn, but it has happened — although a drop can also follow. With the rise of decentralized finance (DeFi) protocols, coin burning has become more common. If you own the tokens that are being burned, then yes, you would lose the value of those tokens.

Burning to Promote Mining Balance

The strategic maneuver creates scarcity, he explained, thereby boosting the perceived value of a coin. This increases demand simply because there would be fewer available units attached to a specified good or service. The advantage of proof of burn is that it’s an efficient way to validate transactions and doesn’t have the energy requirements of the proof-of-work model. While fiat currencies are inflationary in nature and central banks can print them in unlimited amounts, some cryptocurrencies are deflationary in nature and have fixed supply limits.

Proponents of this method consider it an efficient way of verifying transactions because it does not use any real-world resources. This is a technical process, but it essentially entails telling the smart contract the number of coins they want to burn. The smart contract will then verify that they have enough coins in their wallets and subsequently executes the burn. The smart contract will send tokens to a randomly generated address that’s inaccessible.

Enters Shiba Inu (SHIB)

Therefore, any coins sent to an eater address are unrecoverable and cannot be used again, forever! These coins are effectively taken out of circulation and is publicly recorded and verifiable on the blockchain. Cryptocurrency addresses serve the same purpose for sending and receiving digital currencies. When a token is sent to a burner address, it is effectively removed from circulation since the address lacks a private key to access the tokens.

This reduces the supply, which theoretically acts to increase the currency’s price and benefit investors. Proof-of-burn or burning of coins/tokens by sending them to an unspendable address is applied to different cryptocurrencies. This is purposely done to create an economic scarcity so that the token/coin HODLers benefit from what does it mean to burn crypto it. It is mainly used to prevent fraud by automatically verifying every transaction. It also supports the ability of miners to mine new coins, as some cryptocurrencies require miners to burn coins first to mine new blocks. The content of this article (the “Article”) is provided for general informational purposes only.

What are crypto burns?

The token burn event contributed to the increased scarcity of SHIB and its potential for a significant price increase in the future. Proof-of-burn (POB) is an environmentally friendly consensus algorithm in some cryptocurrencies. Miners showcase their “proof of work” by burning or destroying some coins. When a project conducts a token burn, it often catches the attention of traders and investors, increasing trading volume and liquidity and ultimately helping the project regain its competitive edge. Token burns show a project’s commitment to maintaining value, supporting growth, increasing investor trust, and attracting new supporters.

With proof of burn, crypto miners need to burn their own tokens to earn the right to mine new blocks of transactions. In return, participants receive rewards in the cryptocurrency they’re mining. It is permanently removed from circulation by sending the coins to an unspendable address, also known as a “burn address,” where they cannot be accessed again. Although POB doesn’t destroy coins permanently, it effectively removes them from circulation, creating scarcity and combating inflation. The impact of coin burns on price is generally long-term, as burns have limited short-term influence.

Recovering lost coins

Look out for red flags like anonymous founders, unclear project objectives, no real token use case, and a non-existent project roadmap. Also, never reveal your wallet’s private keys if you are asked to as part of a project’s token burn. If someone is asking for your private keys or recovery phrase, they are trying to scam you.

Comentarios recientes